How the United States' Economy is really going ? Going into deep analysis.

What about the actual rally in the US stock market ? Is there any good reasons that are making prices going up or is it just a very euphoric situation where investors are just thinking that markets will rise for ever ? VIX is at very low levels while time is a risk factor.

In this article we will try to answer to this question. That is clearly not an easy task but we can achieve it by looking to concrete facts. Also we will go a bit further by trying to guess when the next market's correction is going to happen and how to protect yourself of a potential market crack and how to profit from it.

The first question to answer would be : are the economy's pillars weak or strong ?

Let's have a look at the Nicholas Kaldor's magic square to answer this first question.

This "magic square" is considering what Nicholas Kaldor considered to be the most important economy's pillars.

These pillars are : the Growth, the International trade, Inflation and employment.

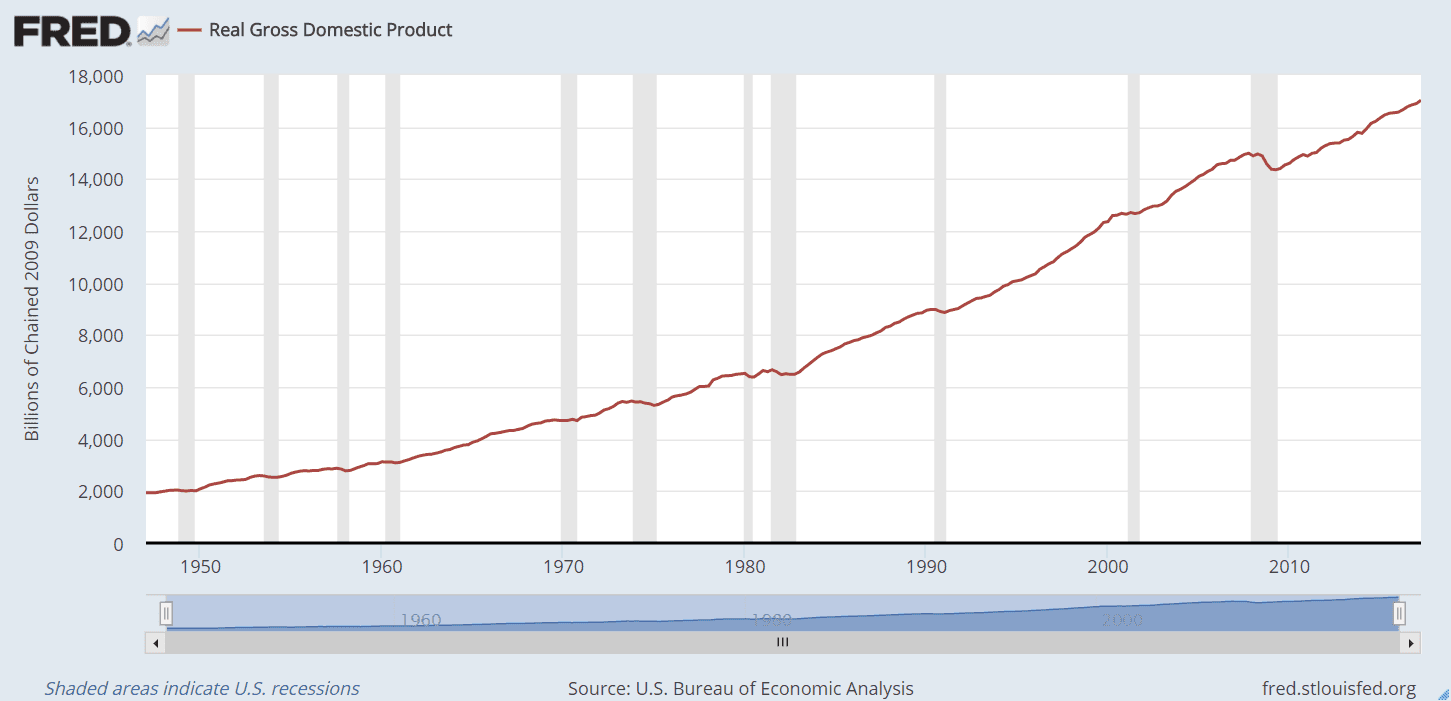

Let's have a first look at the growth.

As you can see, the GDP (Gross Domestic Products) is rising since 1950 and even before. You can see a little decline during the 2008 crisis. So what to conclude if the GDP is rising ? The answer is NOTHING. We have to dig dipper into our economy's analysis and consider much more indicators.

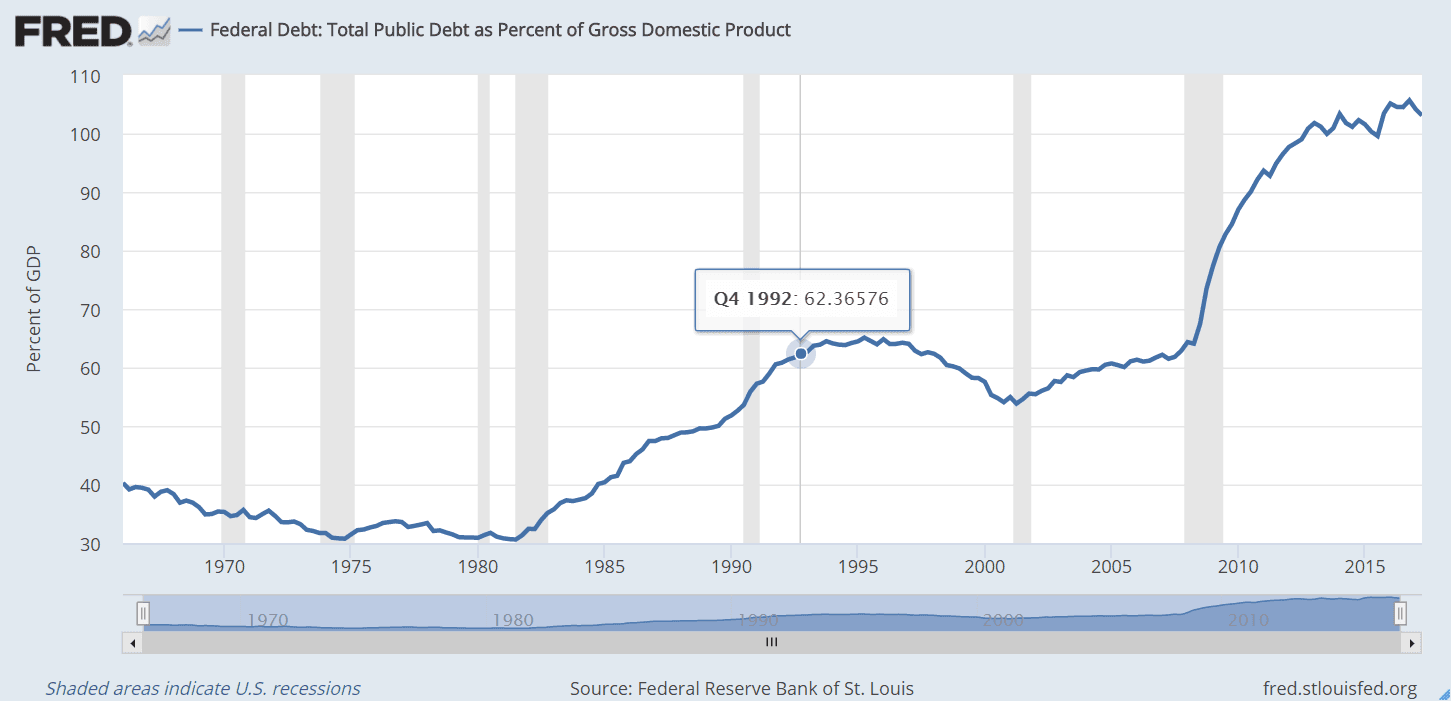

Let's have a look at the US debt. Of course you might have already heard about the debt and that's a good thing ! If the US are showing a constent growth, we have to see how much this growth is healthy. The first thing I can say is that the growth is definitely not healthy. Let's do simple maths. A friend of us, named Jack, is a trader who earns $55 / day. As he is a professional trader, he is using a very expensive trading platform, like the Bloomberg terminal for example (Yeah Jack seems to be definitely a professional). Bloomberg's terminal costs around $24 000 a year which is equal to approximately $65 / days. So finally, Jack is spending $65 each days to win -$10 per day. His real growth is in reality -$10 each days. So jack is probably borrowing money to grow his account (But in reality his account doesn't grow)

It is pretty much the same with countries but a bit more complex. States a borrowing money from banks to finance their development and therefore, their gross. But it doesn't really work. The chart below illustrates it in a very visual way.

With the chart above, you can clearly see that the US debt is above 100% of the GDP (around 105%) which simply means that when the economy earns $100, she is at the same time loosing $105. So in reality she is loosing $5. Note that debt surged during the subprime crisis from a bit more than 60% to 105% nowadays. But how debt is made ? When a country needs money, it simply borrow money to banks with interest rates. We will talk about interest rates later. So the more money a country is borrowing, the more dangerous it is because it has to refund the banks and to pay them an interest rate ! It is a vicious circle and we are actually trapped in it. The whole economy is trapped into debt's problem !

To borrow money, countries are selling assets to central banks. Then, the central banks which are in reality ahead of the commercial banks and that is why we could name the banking industry the bank cartel, are earning interest rates on what we can name a giant loan. So banks are earning money by making loans to countries with interest rates, making them more and more dependent. That is how banks have a total control over countries.

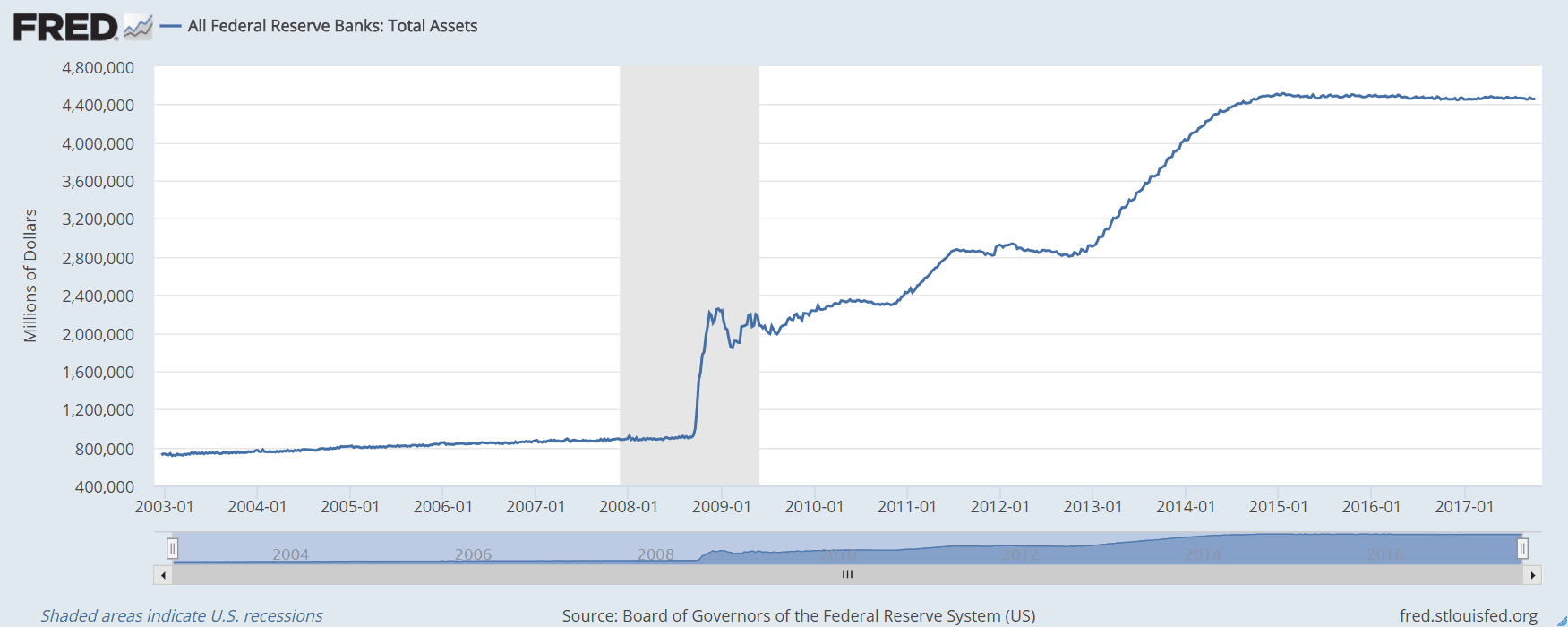

Now, it can be very risky for banks to make loans because it can arrive a time when countries can't assume refunding banks and paying interest rates. Therefore banks are not guaranteed to be paid. Actually the Federal Reserve's balance sheets is very high and it will be forced to reduce it if interest rates are raised. The process is very simple, if the Federal reserve is rising interest rates, the United States will pay more interest rates and because the debt is already above 100%, it would be dramatic.

So the only option would be to reduce this balance sheet which will be the inverse of a quantitative easing. Markets will fall immediatly and it could be the beginning of a panic (short or long term depression).

Here is the Federal Reserve's balance sheet : (All the assets she bought to states)

So I guess we will be agree to say that the US economy is in trouble.

Now let's take a look at the other components of the US economy !

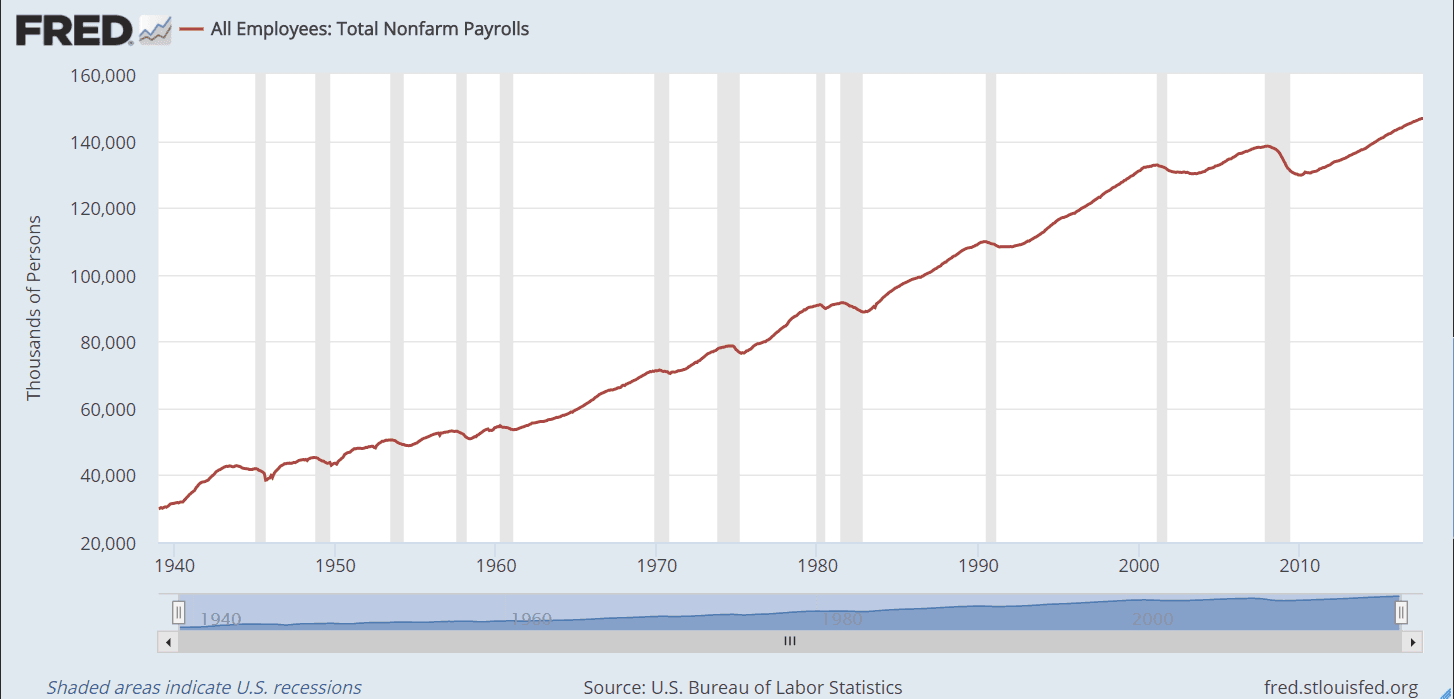

What about employment ?

Well, employment is going well so more and more people are finding jobs in the united states ! Maybe it is only the result of the quantitative easing lead by the Federal Reserve. However, statistics are good when looking at the nonfarm payrolls. (NFP)

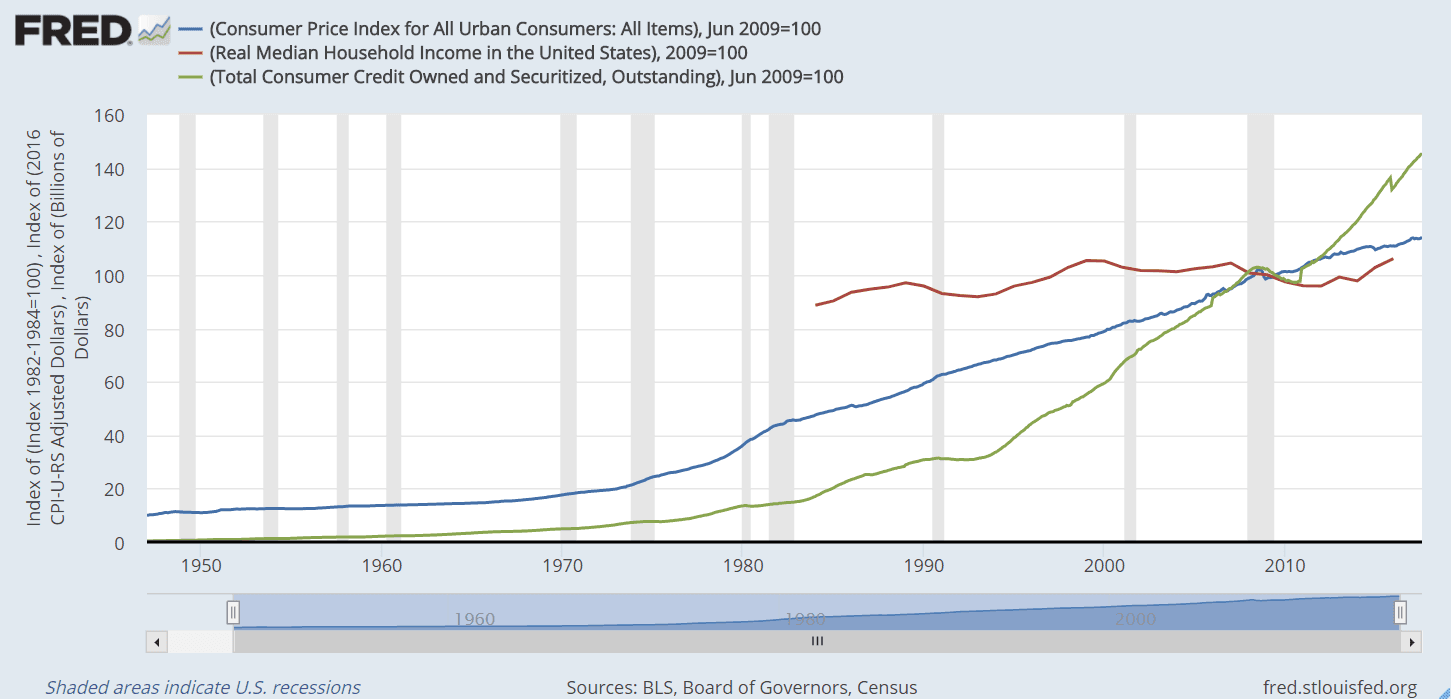

How Inflation is going ?

Inflation is very linear and keeps rising. In other terms, Prices are rising, but can the US population afford it ? Not sure.

Economy is a big puzzle and we simply have to organize all the pieces to have the big pictures. Collecting these pieces is just simple as asking yourself the good questions like in this case : "Ok prices are going up but can the US citizens afford to pay more expensive products ?" To answer this question, you can have a look at the the US median income and make your own opinion.

So let's answer to this question and to another : "If people can't afford paying more, then are they requesting more credits ?"

Having a look at the chart below will definitely help us to understand the situation :

So what we see here is that the income is not really moving up nor moving down while the prices keep rising. Indeed, there is a lot of people that are asking their banks for consumption credits. It is very dangerous but it is hard to say if we could have the same type of crisis as 2008 because regulators put restrictions in order to avoid letting banks making loans to risky people. The NINA loan (No Income No Asset) was really catastrophic because somebody without money of any kind was able to borrow money. Loaning money to someone who is unlikely to refund the bank is called a subprime. The thing is NINA loans still exist ! Some financial institutions are also specialized in this activity !

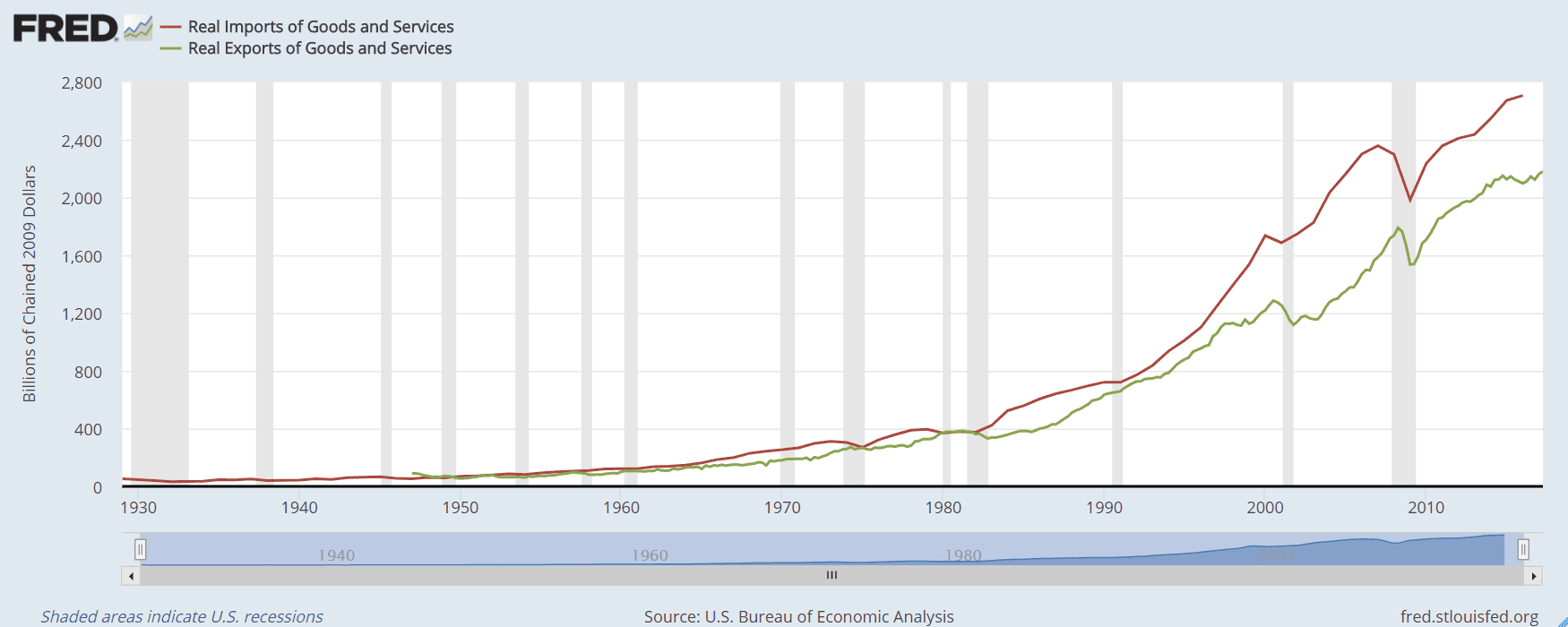

The US international Trade

Our economist Nicholas Kaldor, with his famous magic square, was talking about a "commercial balance equilibrium" which simply means that the total sum of exports is equal to the total sum of imports.

In the chart above, the red line is showing imports and the green one is showing the exports. As you can see we are definitely not in an equilibrium situation but in a situation where the country is loosing money abroad. The gap between imports and exportations seems to be expending. We know that China for example is good at exporting us a lot of goods but why this gap is expending ? Hard to answer. But, we could make a forecast by considering the political aspect of the United States. If the president, Donald Trump comes to close the trade's borders, it could have a big impact on the US international trade. If he does, the value of imports and exports will fall and the gap should be reduced but it all depends on which products and which sectors are concerned.