Which trading platform for your automated trading ?

There is many factors that may impact on your trading platform choice. Let's see together all the features of the actual trading platforms.

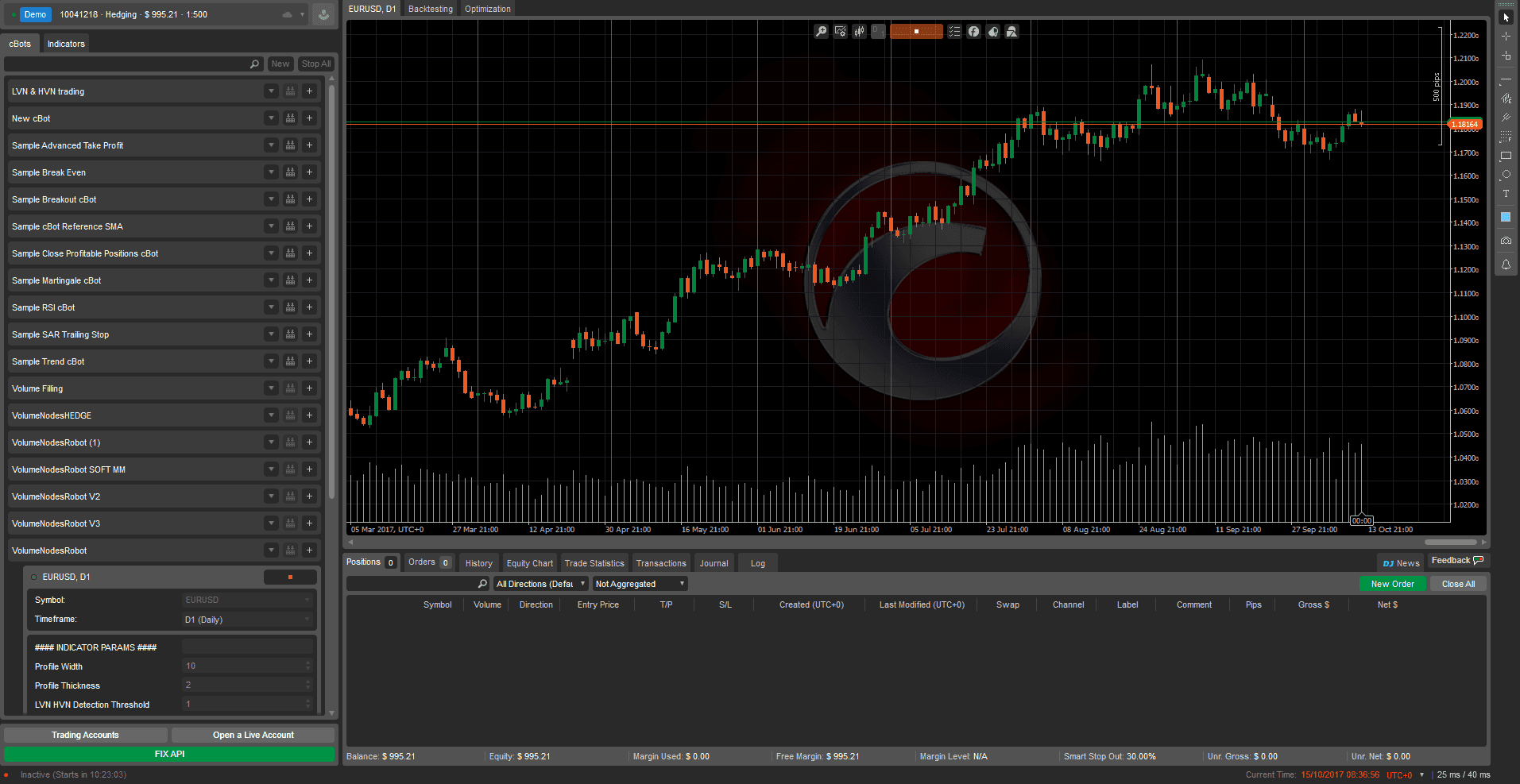

cTrader (cAlgo)

This trading platform is not as well known as Metatrader but can be very powerfull !If you are an automated trader, which means that a trading robot is placing orders for you, then cTrader can give you a real benefit.

cTrader is very fast. Your orders can be filled in just 100ms or even less. With other platforms, it can vary a lot, sometimes you have a excution latency of 100ms while an other time your market order will be filled in 1 second ! So counter to other platforms like Metatrder, cTrader is very regular concerning execution latency and it is very important for you if you have a 100% automated trading strategy.

Volume is very important for trading as it is one of the main market's information. cTrader can provide you with advenced volume ananlysis like :

- DOM (order book)

- Tape reading

Unfortunately, the DOM is the broker's activity. This is not the real DOM. Also keep in mind that FOREX market is decentralized and therefore has no order book. But, if you need to analyse FOREX depht of market, it is possible trough futures. For the EUR/USD for exemple, you can analyse the 6E future contract which will give you real insights when analysing the limit orders.

To do so, you will need an other trading platform. But if you want to trade with futures, you should be ready to invest at least $10k as contracts worth a lot more (There is no nano lots or micro lots).

For automated trading, Spotware created a cTrader version called cAlgo, made exclusively for robots. Below you can see a screenshot of the cAlgo platform.

NinjaTrader & SierraChart

These trading softwares are very similar because they offer the same features like DOM trading, tape reading, the Market Profile indicator, Volume Profile and the Footprint.

Therefore it can be very usefull for your trading if you want to trade futures, manually or even in an automated way.

NinjaTrader will give you all the trades statistics and allow you to see how exactly your strategy is performing. You will be able to see your profit factor, your drawdown, the average monthly return, the sharpe ratio and a lot more without calculations.

NinjaTrader programming language is C#. It is quite a reliable language that can assure you that your algorithm will work properly.

Sierra Charts is using the C++ language that is one of the best languages.

So these trading platforms are really powerfull. You can use NinjaTrader for free but you will need to subscribe to market's data if you need real time data (you will definitely need it if you plan to do algorithmic trading). Kinetick is probably the best data provider and it will be very easy to use your market data with the NinjaTrader platform. SierraCharts isn't free to use but you can benefit from a free trial to test it in see if the plateform fits with your needs.

ProRealTime

This is probably one the best trading platform we can use because of these 3 important facts :

- Free to use for active traders with IG Markets Brokerage

- You can access to a wild range of markets like stocks, Forex, commodities, sectorial indexes, options and a lot more.

- A trading DOM is available and can be completed by a TapeReading window.

Also one of the most interesting feature of the platform is that you can create your own trading strategies whithout programation skills, just by slecting indicators or market's elements such as price, and define trading conditions.

Of course, if you need a very sophisticated trading robot, thenyou will need to code your strategy or ask a coder for it. Programming services are easy to find for this platform. ProRealTime are programming themselves for their clients if you ask them.

You can also create screeners to help you finding some meaningfull market paterns.

ATAS Order Flow

This platform is not very well known but it should be as it is very interesting. The main benefit of this trading platform is the ability to have access to a horizontal DOM (a DOM heatmap where you can see historical and actual limit orders at the bid and at the ask.)

It is simplifying the read of the order book asyou will be able to see even an order that reamains 200ms in the book.

ATAS also develppoed custom indicators that are very gifted in the task of predicting future market's direction.

To sum up, ATAS is very good at :

- Simplifying the order book reading

- Providing you a Level 2 tool (for stocks)

- Tape Reading with a preasure indication (we see exactly if buyers or sellers are more agressive)

The famous Metatrader

Metatrder has pros and cons. It is a good platform for a specific kind of trading strategy. Because there is no access to market's real time volume, you can forget about order flow strategies. But to be honest, order flow strategies are very complex and may not be accessible for little investments.

MetaTrader is good for :

- Chartism

- Manual Trading

- Automated trading (momentum, price action or technical analysis strategies)

- Manage your funds with ease.

Also, there is a lot of programmers for this platform so you will be able to compare prices (READ THIS ARTICLE TO KNOW HOW TO OBTAIN A GOOD PRICE ON YOUR TRADING ROBOT)

If you are looking for a good execution speed, then you should test MT5 which is a bit faster than MT4.

Conclusion :

These trading platforms are different and are designed to fits with different needs. They are all compatible with automated trading and each of the trading platforms will succeed to run your Expert Advisor.