Every thing you need to know to trade the market's volatility

Volatility is inherent to markets. You probably had been trapped in a non volatile market that didn't want to go up or down. But the reverse is true ! Sometimes you enter into a position and almost immediately you find yourself with a huge profit or a huge loss !

So how could we anticipate market's volatility ?

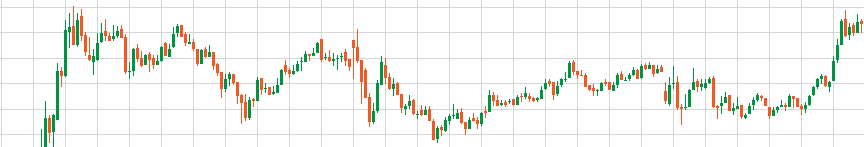

For sure you ever heard about the bollinger bands. These bands are in fact two standard deviations of a moving average. The first Standard deviation is below the moving average (a negative standard deviation) and the other one is above the moving average.

The pattern we can see with bollinger bands is as simple : when the gap between the 2 standard deviations is high, then volatility is high too. But when the 2 bands are getting closer, it means that volatility is decreasing. This way you can easily see what is the market volatility.

Usually, when the two bands are close for a long period, it means that the market is preparing to explode in a direction. But the problem and the most important question remain unanswered : which direction to trade ?

Let's have a look at another way to trade volatility

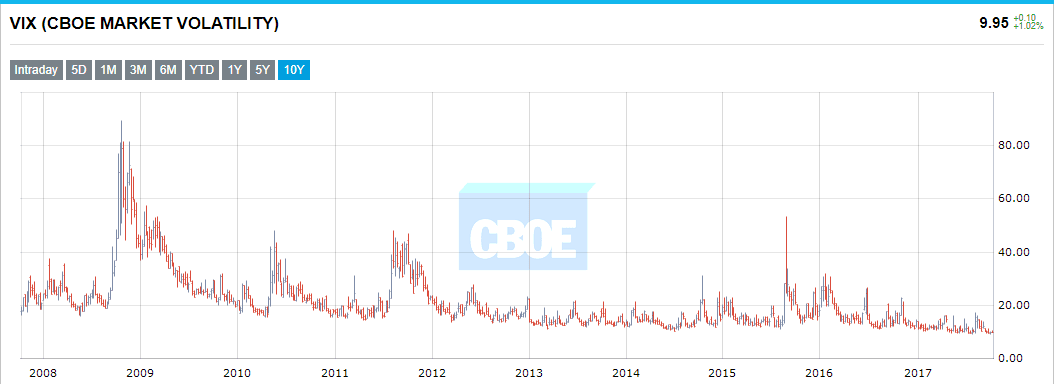

Volatility is also measured with the VIX (fear index). This index is tracking the S&P 500's volatility and has the specificity to go up when the market is in panic and to be down when the market or more precisely market participants are anticipating a good economic environment and indeed a bullish and confident market. The VIX tends to quote around $10 and $15 when markets are stable. During the 2007 - 2009 crisis, the VIX reached the level of $89 ! It would have been a profit of +800% without leverage!

It is a fantastic opportunity that you should catch right now !

The little difficulty that you could face is to find a broker that offer trading on VIX. In fact there are some brokers that are just offering ETFs that are not correlated to the CBOE's VIX index. So what you need is a broker that offer you the opportunity to invest on the VIX with small positions.

I found one and only one that is accessible for everyone.