AAPL - Get ready for the next big move... or not

Everyone knows it, APPL is going up since its early times.

Good new is that you could catch a bit of this uptrend if you missed this train to fortune by not investing in 2003 or even in 2010.

The stock just made a bullish break-out, meaning that technically stock should continue its north direction road.

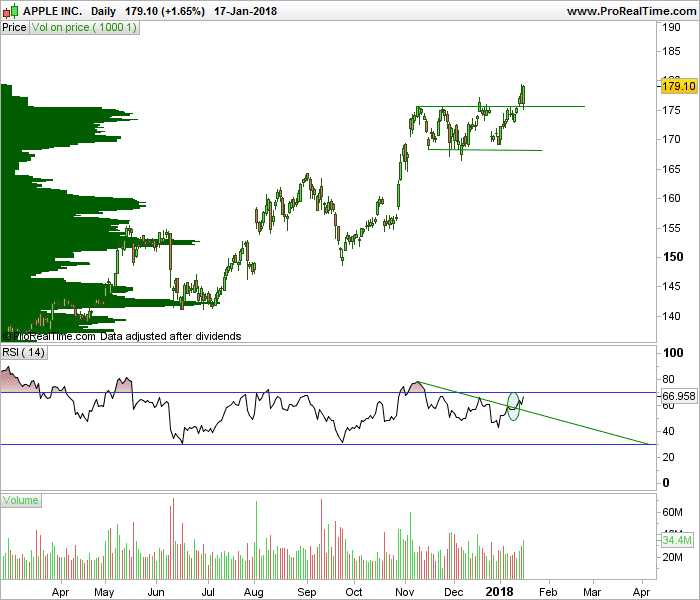

The chart below is in daily timeframe.

We can clearly see that the resistance had been broke but not only. If you have a look at the RSI, you can see that the indicator was diverging from the market's price. This divergance had been broke, meaning that buyers seems to be coming back. This divergance helps us to confirm the breakout by providing us another technicall hint.

The daily chart above is about short-term forcasting. Now, let's see the Monthly chart to have a better view of the long-term stock's behavior.

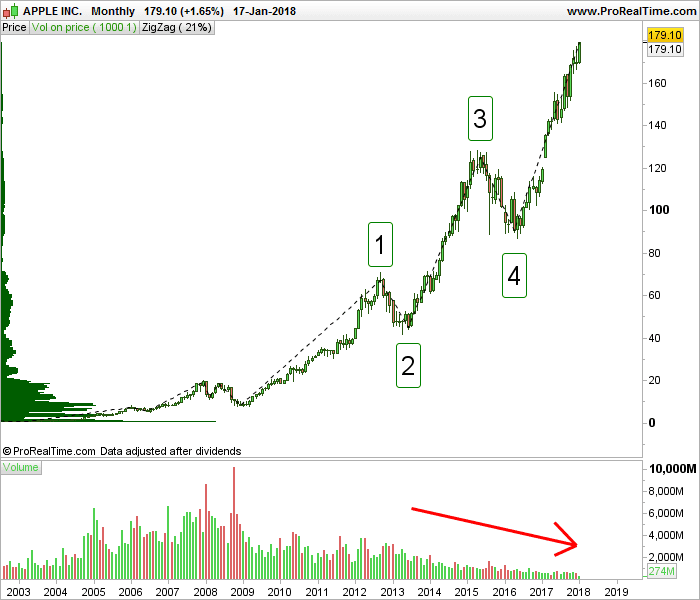

Elliott waves are shouting us that timing would be very bad, considering to enter long now. As you can see, the market is in its final cycle (wave 5) so the next long-term move could be very soon and should be bearish. Also note how volume deacrease with time, saying that less and less people are investing.

Conclusion:

entering long could be a good idea, only to catch a small profit with a swing trade. Placing a Stop below the ex-resistance and taking profits with a trailing stop could be the right strategy to deploy as long-term uptrend could end soon.